Bankruptcy - Florida

When credit card debts become so unmanageable that consumers are unable to make their payments due to a number of reasons (such as a job loss, disability or unexpected medical bills), the word "bankruptcy" may come to mind. If you are also overburdened with high-interest credit card debts and looking for relief, you can breathe a little easier because there are many ways to get debt relief without bankruptcy - including debt consolidation through credit counseling and debt settlement.

Bankruptcy may remove your obligation to pay the majority, or even all of your debts, however, this option often results in negative consequences for your credit. That's why many consumers have made debt consolidation and debt settlement popular alternatives to bankruptcy because the impact to personal credit as a result of either debt consolidation or debt settlement is not nearly as damaging or long lasting than bankruptcy.

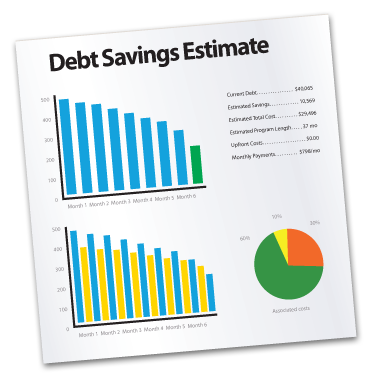

If you want to find out how much you can potentially save by either consolidating your debts, or through debt settlement, request a free debt relief analysis and savings estimate.

Debt Consolidation Alternative

Many consumers like you who are struggling with credit card debts, as well as other types of unsecured debts (such as medical bills, department store charges, or utilities) have a wealth of debt relief options to choose from other than bankruptcy. As noted earlier, one viable option is debt consolidation, or a debt management plan (DMP). The goal of debt consolidation is to provide consumers with a single, more manageable, and more structured payment plan made to a credit counseling agency.

Typically, credit counselors coordinate a debt management plan that allows consumers to make one, consolidated payment each month. After making an assessment of your outstanding debts and ability to pay off those debts, they submit proposals to your creditors, on your behalf, requesting reduced interest rates, or the waiving of any late fees and penalties. Creditors that agree to those proposals are then placed into the debt management plan. An account is generally set up from which the credit counseling agency draws money to distribute to the various creditors in the debt management plan. With a new, more affordable and more structured repayment plan in place, you can, ideally, direct more of your payment towards paying off the principal balance on your credit cards versus just the interest.

If you want to find out how much you can potentially save every month by consolidating your debts, answer a few questions to get a free debt relief analysis and savings estimate. Begin here.

Understanding Debt Settlement as a Bankruptcy Alternative

Another proven debt relief option for many consumers is debt settlement. Unlike debt consolidation where you pay all of your debts, just at lower interest rates - with debt settlement, you are hoping to settle for substantially less than what you owe. However, as the term "settlement" suggests, creditors are certainly not legally required to accept the settlement proposal. Many consumers are typically advised to stop paying their credit cards in order to save up funds, over an extended period that they can later use to offer a reasonable settlement offer to creditors. In these cases, creditors may threaten to sue consumers who default on the terms of their credit card agreement. Plus, those who default on the terms of their credit card agreement may see their credit scores decline.

However, in spite of the risk of getting sued or the impact to their credit score, many consumers still consider debt settlement a popular alternative to bankruptcy - which, as mentioned earlier, can have a more devastating and longer lasting effect on personal credit. That's why it is a smart move to explore and compare all your debt relief options - including debt consolidation and debt settlement - and find out which option may get you on path to becoming debt free. Find out how debt relief can help you by requesting a free debt relief analysis and savings estimate - at no obligation to you.