Filing Bankruptcy in Florida - Can You Avoid It?

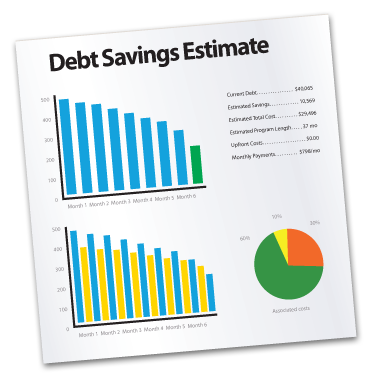

Many individuals and families in the state of Florida who are considering filing bankruptcy may feel that bankruptcy is their only option. While bankruptcy can provide a fresh start and a way out of debt, it is not for everyone. Bankruptcy brings with it a significant and serious impact on your personal finances and credit for many years to come. The good news, if you are in need of debt relief -- you may be able to get relief without bankruptcy. This could, not only remove stress, but possibly save you thousands of dollars as well. Get Your Free Debt Relief Analysis and Savings Estimate at no obligation.

People are searching for bankruptcy filing information more and more, and in the last few years bankruptcy information requests have been on the rise, and for good reason. As economic conditions worsen, bankruptcy filing in Florida and nationwide is also increasing. Individuals throughout the Sunshine State are seeking relief from painful debt and many are filing for bankruptcy protection. And while many people with overwhelming or problem-debt are taking-on the filing process themselves, many leading financial experts believe self-guided bankruptcy efforts can and do lead to costly mistakes and set-backs. It may not be advisable to file bankruptcy yourself in Florida or anywhere for that matter, but rather to seek reliable bankruptcy information and guidance from a bankruptcy specialist, a bankruptcy lawyer or attorney. Bankruptcy laws are complicated and may not be easily navigated by well-meaning debtors who sincerely believe filing bankruptcy yourself will result in lower cost and money-saved.

Bankruptcy Defined

Bankruptcy, bankruptcy laws and bankruptcy codes, most specifically, Chapters 13, 11 and 7, are a legal process which declares and addresses the inability and/or the impairment of a person or business entity (a corporation for example) to pay creditors' monies-owed and outstanding debt obligations. While bankruptcy can be initiated or requested by creditors, in most cases, the bankruptcy is begun by the individual or entity seeking the protection afforded by bankruptcy laws. The main intended purposes of bankruptcy and bankruptcy laws include extending to a debtor, a so-called new beginning or fresh-start and in doing so, relieving that debtor of the bulk of existing debt. Secondly is bankruptcy protection.

Chapter 13

Chapter 13 bankruptcy and protection can allow a debtor to repay creditors in an orderly manner - provided the debtor has the income and economic means to repay that debt in a manner structured by the court. The specific intent and purpose of Chapter 13 bankruptcy is to seek the payment of debt in that person or entity's name and to seek better payment terms, including a lowering or suspension of interest attached to that debt. Chapter 13 bankruptcy filing and intended outcomes include the restructuring of debt. Chapter 13 bankruptcy candidates should have regular and sustainable income which allows the court to apply reduction and adjustments to debt. Debt pay-back periods, under Chapter 13 are maximized to 5-years, meaning that debtors must be paid (in full) in that time-frame. Bankruptcy laws - while a great tool for the debtor also have positive results for creditors as well. It's truly a win-win for both sides - debtor and creditor - under less than ideal financial circumstances.

For a review of debt relief alternatives to bankruptcy in Florida and to get a free debt relief analysis and savings estimate, simply answer a few questions online.

Chapter 11

Another widely used chapter of bankruptcy law is one we'll touch-on only very briefly in this report. Chapter 11 bankruptcy permits reorganization and is used primarily by business. Its applicability also extends to sole proprietorships and individuals but is used most often by corporate entities.

Chapter 7

The second most accessed part of the U.S. Bankruptcy code is Chapter 7. It involves selling of debtors' nonexempt assets with proceeds used to pay creditors and other claim holders. Certain, and as determined by the courts, so called "exempt property" can be kept by the debtor with remaining assets being subject to liquidation. Therefore, it's important to note that filing Chapter 7 Bankruptcy can and may result in property loss.

In Chapter 7 Bankruptcy a petitioner (debtor) to the court must provide the following

- Complete list of creditors

- Claim amount and type of claim

- All income information - amount, source of income and pay periods (frequency)

- List of all property

- Living expenses (detailed) listed by monthly amount

As soon as a Chapter 7 bankruptcy is filed, creditors are stopped from all collection efforts. Referred to as an automatic stay, this procedure will also preserve personal property and stop lawsuits related to the debt in question, and do so immediately. If it can be proved, by creditors, that physical deterioration of property during the bankruptcy period will take place - thereby lowering value of that property - collection action may take place.

To review debt relief alternatives to bankruptcy in Florida and to get a free debt relief analysis and savings estimate, simply answer a few online questions. It's free and there's no obligation.

Bankruptcy Information

Information is plentiful on bankruptcy, bankruptcy filing and laws. The Internet is rich with information, and while much of it is academic and accurate, the sheer volume of information and the complexity associated with the subject matter is not to be taken lightly. Glossing over important minutiae and details can be catastrophic - financially and psychologically...and with real-world implications, all too real. When it comes to bankruptcy, make sure you're doing it right.

Bankruptcy Forms

So you still want to do bankruptcy on your own? If you want to go through the details and procedure yourself, take comfort in the fact that bankruptcy forms are found with minimal research and time. Using today's computer and Internet technology, for example, bankruptcy forms are readily available. A person seeking to file in Florida and do it on their own can have all the forms required by law easily, quickly - literally in moments. But get ready, a typical bankruptcy kit will total around 40 pages, much of it legalese, and "buyer beware", these forty bankruptcy forms and the required reading content and questions often confuse, intimidate and flummox even the best-intended, brightest among us. The legalese, not to mention the math, can be daunting and difficult. Filing the right bankruptcy forms at the correct time is also critical. "The devil", as they say, "is definitely in the details."

One More Important Note Regarding Bankruptcy

Depending on one's personal and financial situation, filing Bankruptcy may be the best, in some cases, the only solution for extreme financial hardship. We must advise, however, that bankruptcy should be considered and used as a last resort. Bankruptcy can have positive results for many, but you should know that declaring bankruptcy can have long-term effects. Glossing over its implications could be cause for regret later on. The three credit reporting agencies, for example, may keep your bankruptcy on record and report it for up to ten years. So the effect of a bankruptcy can have long coat-tails. Consult with a financial expert before making a decision to move forward.

Debt Relief Options

If you're a Florida resident considering bankruptcy, prior to filing for bankruptcy - whether you're planning on doing it yourself or engaging the services of an attorney - it makes sense to explore and consider alternative debt relief options. Bankruptcy is serious business and the consequences may not be optimal for every individual. See what debt relief could do for you and how much you could save, either through a debt management plan via credit counseling -- which is really a form of debt consolidation. Or, you may want to consider debt settlement, whereby credit card companies may agree to "settle" credit card debt for less that what you currently owe.

For a review of debt relief alternatives to bankruptcy in Florida and to get a free debt relief analysis and savings estimate, simply answer a few questions online.