Chapter 7 Bankruptcy

If your financial hardship has grown to become too much to bear and you've tried all available means to get rid of your unsecured debt, it may be time to start thinking about filing bankruptcy - even Chapter 7. While generally considered a last resort option that often evokes fear, bankruptcy is not nearly as frightening once you know the facts about how it works, how it may affect your credit report, and what the process entails. Two types of personal bankruptcy apply to individuals - Chapter 7 and Chapter 13. Chapter 7 is known as straight bankruptcy, and involves liquidation of all your properties and assets that are not exempt, and uses the proceeds to pay back your creditors.

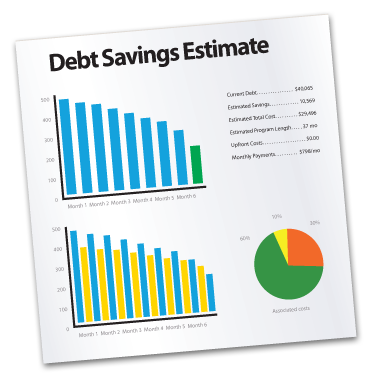

To review debt relief alternatives to bankruptcy in Florida and to get a free debt relief analysis and savings estimate, simply answer a few online questions. It's free and there's no obligation.

Each state has exemptions that protect certain kinds of assets, which may include your house, your car, work-related tools, and basic household furnishings. After any eligible assets have been liquidated and your creditors have been paid, you will no longer be responsible for repaying your debt. Keep in mind that a Chapter 7 bankruptcy filing will stay on your credit report for up to 10 years, and you cannot file for another Chapter 7 bankruptcy for eight years. We can provide you with more information about bankruptcy-related issues as well as companies that offer alternatives to bankruptcy such as debt relief services and programs.

In contrast, under Chapter 13 bankruptcy, you repay all or part of your debt through a three- to five-year repayment plan that is approved by the federal court. Chapter 13 allows consumers with a steady income to keep their assets, like a mortgaged house or a car, which they might otherwise lose through the bankruptcy process. Once you have made all the payments under the plan, you will then be discharged of all your debts. Remember that Chapter 7 and Chapter 13 are designed for individuals; for businesses that are unable to pay back their creditors, they can file what's known as Chapter 11 bankruptcy. Under Chapter 11, businesses can declare bankruptcy but continue to operate under the direction of a court-appointed trustee that reorganizes the business to be more efficient and in a position to be able to pay back its creditors.

For a review of debt relief alternatives to bankruptcy in Florida and to get a free debt relief analysis and savings estimate, simply answer a few questions online.

If you believe that filing Chapter 7 is a good option for you, you must first pass the bankruptcy means test to see if you qualify. Enacted by the U.S. government to make sure that consumers who can actually repay their debts do not abuse the bankruptcy system, the means test compares your monthly income against the state's median family income for a family your size. If your income exceeds the state's median, you may not be eligible to file Chapter 7 bankruptcy. If you fail, your petition may either be dismissed or converted to a Chapter 13 bankruptcy case. But if you do qualify, make sure that you are prepared to send certain forms when filing your bankruptcy petition - forms such as your list of assets and liabilities, your current income, a schedule of any contracts and unexpired leases, and a statement that you received credit counseling from a government-approved organization within six months before you file for bankruptcy. The court will also need a copy of your most recent tax return and any returns filed while your bankruptcy case is ongoing.

Filing for bankruptcy may sound like a daunting process, that's why we have provided this information for you so you can consider all the facts before proceeding. Whether you choose to file for Chapter 7 or Chapter 13 bankruptcy, keep in mind that bankruptcy can provide a fresh financial start but it is a serious financial decision that should be taken only after considering all factors such as level of debt, current assets income level, credit standing, and more.

To review debt relief alternatives to bankruptcy in Florida and to get a free debt relief analysis and savings estimate, simply answer a few online questions. It's free and there's no obligation.