Chapter 13 Bankruptcy

Out of all the debt relief options available today, filing Chapter 13 bankruptcy is oftentimes one of the least favored and raises the most questions among people. For some, the very thought of declaring bankruptcy conjures up thoughts of them losing all their belongings and ending up on the streets. But most of these fears are unfounded, as we are about to show you.

Bankruptcy, in some cases may be a good option if you are severely hampered by unsecured debt that will most likely take you years to pay off. You will find that there are two types of bankruptcy that apply to individuals - Chapter 13 and Chapter 7 bankruptcy.

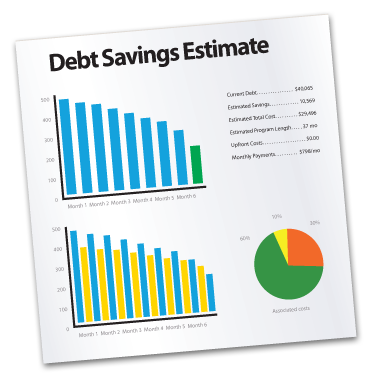

To review debt relief alternatives to bankruptcy in Florida and to get a free debt relief analysis and savings estimate, simply answer a few online questions. It's free and there's no obligation.

Chapter 13 will require debtors to pay some or all of their debts through a court-approved repayment plan - usually lasting three to five years. Under Chapter 13 bankruptcy, people with a steady income will typically get to keep some of their assets, like a house or a car, which they might otherwise lose through the bankruptcy process. Once you have made all your payments, you will be relieved of your debt. While informational sites such as Wikipedia can provide some summary info about bankruptcy options, it's wise to get advice from a bankruptcy attorney who understands all the nuances of bankruptcy law for your particular state.When it comes to Chapter 7 bankruptcy, this is the form of bankruptcy that known as "straight bankruptcy." It involves liquidation of all your properties that are not exempt, and uses the proceeds to pay back your lenders and creditors. What is considered non-exempt property varies from state to state, so it's best to consult with a financial expert or maybe an attorney to determine what you're allowed to keep based on your state's bankruptcy rules. After your eligible assets have been liquidated and your creditors are paid off, you will be relieved of your obligations to pay your debts.

Keep in mind, though, that filing Chapter 7 bankruptcy won't wipe out all kinds of debts - such as alimony, child support, and student loans. It's also important that you don't confuse Chapter 7 or Chapter 13 with corporate bankruptcy, or what's also referred to as Chapter 11 bankruptcy. When a business files Chapter 11, it is declaring that it can no longer service its creditors, and that it is seeking protection from any legal action by its creditors. That business will continue operations, however, it is now under the direction of a court-appointed trustee who will reorganize the company and turn it around so that it is able to pay back its creditors.

For a review of debt relief alternatives to bankruptcy in Florida and to get a free debt relief analysis and savings estimate, simply answer a few questions online.

For many consumers who are facing financial hardship due to mounting credit card bills and other unsecured debt, filing bankruptcy may be a viable option and a good step towards gaining financial health. The first step in the process is to pass the means test. Established by the government to make sure that consumers who have the financial resources to pay back their debts did not abuse the bankruptcy system, the means test compares your monthly income against the state's median family income for a family your size. If your income exceeds the state's median income, you may not be eligible to file personal bankruptcy.

But if you do pass the means test, there are several things you can do to ensure that the process goes on smoothly. Make sure you gather all the necessary forms when filing your bankruptcy petition, forms like a record of your assets and liabilities, copy of your current tax return, stubs, deeds, automobile titles, your current income, or a statement that you received credit counseling from a government-sanctioned organization within six months before you filed. If you need more information about Chapter 13 or Chapter 7 bankruptcy, or any other debt relief method, we can connect you to debt relief companies who specialize in a variety of debt relief alternatives to bankruptcy, including debt consolidation, debt management, or even debt settlement.

To review debt relief alternatives to bankruptcy in Florida and to get a free debt relief analysis and savings estimate, simply answer a few online questions. It's free and there's no obligation.