Bankruptcy Attorneys

While information is plentiful - from directories to the Internet, regarding bankruptcy attorneys and debt relief, it's advisable to do some research before plowing forward. It's also advisable to enlist the services of a professional bankruptcy attorney. Going it alone is simply too much to handle for many. Bankruptcy is a complex arena demanding experience and know-how.

Bankruptcy Attorneys for Florida Residents

Filing bankruptcy in Florida and then optimally benefiting from U.S. bankruptcy law and bankruptcy codes, and then finally realizing maximum protection for optimal results - takes a strategic approach.

It also takes a professional.

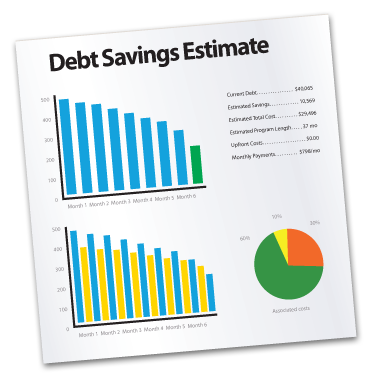

To review debt relief alternatives to bankruptcy in Florida and to get a free debt relief analysis, along with a free savings estimate, simply answer a few online questions. It's free and there's no obligation.

Filing bankruptcy, from Chapter 7 to Chapter 13, is a serious undertaking and takes a commitment - if the objective is complete, full, and unmitigated success - and requires the full services of a bankruptcy attorney. The mistaken and often incorrectly held belief is that bankruptcy attorney fees are "through the roof" and unreasonable. Clearly, nothing could be further from the truth. It's the rationalized and systematic failure not-to, that can be costly. Let us explain.

Services Offered and Costs to Think About

Enlisting the services of a Florida bankruptcy attorney brings to the table vital benefits. New bankruptcy laws recently enacted have increased not only the complexity of required legal procedure, but along with that a nominal increase in fees Florida bankruptcy attorneys routinely charge --using a sliding-scale and based upon a debtor's income. Why? Because the amount of work and corresponding fees can and do vary based on a debtors' income level.

Chapter 7 Fees in Florida

If you're considering a bankruptcy attorney and are a debtor residing and filing for Chapter 7 Bankruptcy in Florida, falling below or close to what's deemed a "median" Florida income, will pay approximately $2,000 in legal fees. Add to that a $299 court filing fee, plus law-mandated bankruptcy education classes, and you've got a total bankruptcy-cost that by most legal-cost-work-load standards, is both reasonable and fair. Debtors exceeding the median Florida income-level can expect to pay $300 to $500 more. This is due to the extra paperwork and work-load required by the law firm to process the case.

For a review of debt relief alternatives to bankruptcy in Florida and to get a free debt relief analysis along with a savings estimate, simply answer a few questions online.

Chapter 13 Fees in Florida - A Comparison

What about Chapter 13 as it relates to debt relief and bankruptcy? While general-income fee parameters similar to above apply to Chapter 13 filings, fees will be higher. Chapter 13 cases are by their very nature more complex and time-intensive with average costs for median income holders, averaging around $4,500 for legal fees. Court-fees and other incremental costs still apply but the total should be well south of $5,000 to file and bring to completion a standard Chapter 13 court filing and case work-load.

Chapter 11 - A Brief Mention

Another widely used chapter of bankruptcy law involving attorneys and debt relief and one that deserves a mention is Chapter 11 Bankruptcy. Not as widely used on a per capita basis compared to 7 and 13, Chapter 11 permits reorganization and is used mainly by businesses. Sole proprietors and individuals do use the chapter, but most often its protection and benefits are sought by corporate entities.

To review debt relief alternatives to bankruptcy in Florida and to get a free debt relief analysis, along with a free savings estimate, simply answer a few online questions. It's free and there's no obligation.

Associated Costs - Bankruptcy Education Classes

The newly enacted Bankruptcy Act of 2005 - ostensibly aimed at consumers filing bankruptcy - mandates with few exceptions, mandatory debt credit counseling prior to filing and pre-discharge debtor education prior to discharge. In fact, attorneys routinely advise all bankruptcy clients take the required mandates. These sessions cumulatively take from one to two hours and can be accomplished in person, on the phone, or online. Bankruptcy petitioners will need to file a certificate of credit-counseling-completion before filing and proof of debtor education after filing but prior to discharge. Education and counseling costs will average for both Chapters 7 and 13 filers between $50 and $100.Bankruptcy Information - Debt Relief Options

Florida residents thinking about bankruptcy, attorneys, and prior to filing for bankruptcy should examine and explore alternative debt relief options as well. Bankruptcy - as an offensive weapon against staggering debt - is something not to be approached lightly or without serious consideration. Clearly as effective as bankruptcy is, it may not be optimal for every individual. See what debt relief can do and how much you could save through any of a number of debt relief programs.

For a review of debt relief alternatives to bankruptcy in Florida and to get a free debt relief analysis along with a savings estimate, simply answer a few questions online.